Insurance underwriting is a critical yet complex process that involves assessing risk, pricing policies, and making high-impact decisions that directly influence profitability. Despite the importance of these tasks, underwriters often find themselves buried in administrative work, spending more time searching, aggregating, and understanding fragmented data rather than focusing on making informed, strategic decisions. This is where GoodData steps in, revolutionizing the underwriting process by offering a comprehensive solution that integrates real-time data and insights into decision-making workflows.

Underwriting Insights: Faster, Integrated, and Profitable Decisions

GoodData transforms the underwriting process by enabling underwriters to access all relevant information in one place. With its powerful data aggregation capabilities, it connects seamlessly to both internal and external data sources, providing underwriters with a holistic view of each submission. The result is a faster and more integrated decision-making process that enhances profitability. By reducing the time spent on manual data aggregation and allowing underwriters to focus on evaluating risks, underwriters can make more accurate and profitable underwriting decisions.

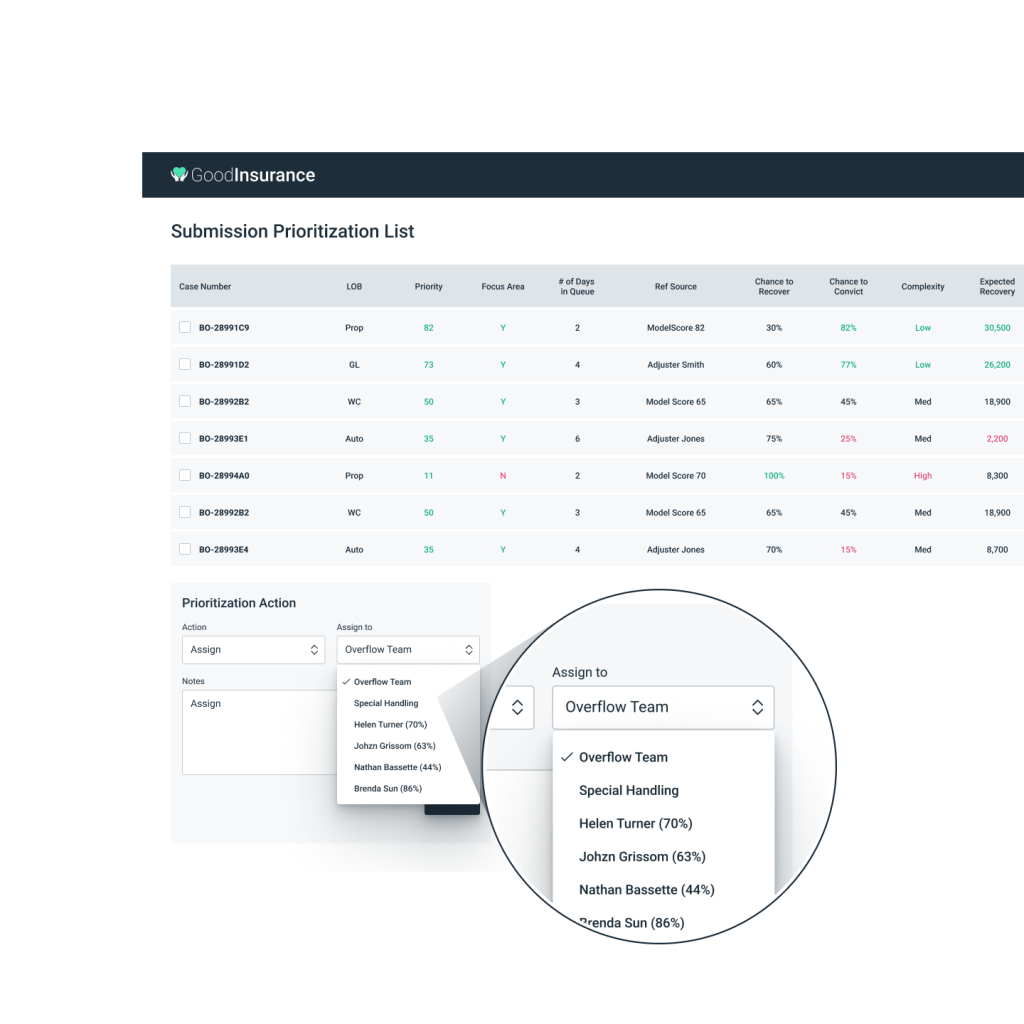

Submission Insights: Prioritization for Better Business Outcomes

Managing a high-volume submission queue is a constant challenge for underwriting managers. GoodData’s submission insights feature helps managers prioritize submissions based on key information and performance metrics. By highlighting the most important aspects of each submission, underwriters can better allocate their time and resources, ensuring that the right person handles each case. This strategic approach ensures optimal decision-making, improving the likelihood of better business outcomes while increasing operational efficiency.

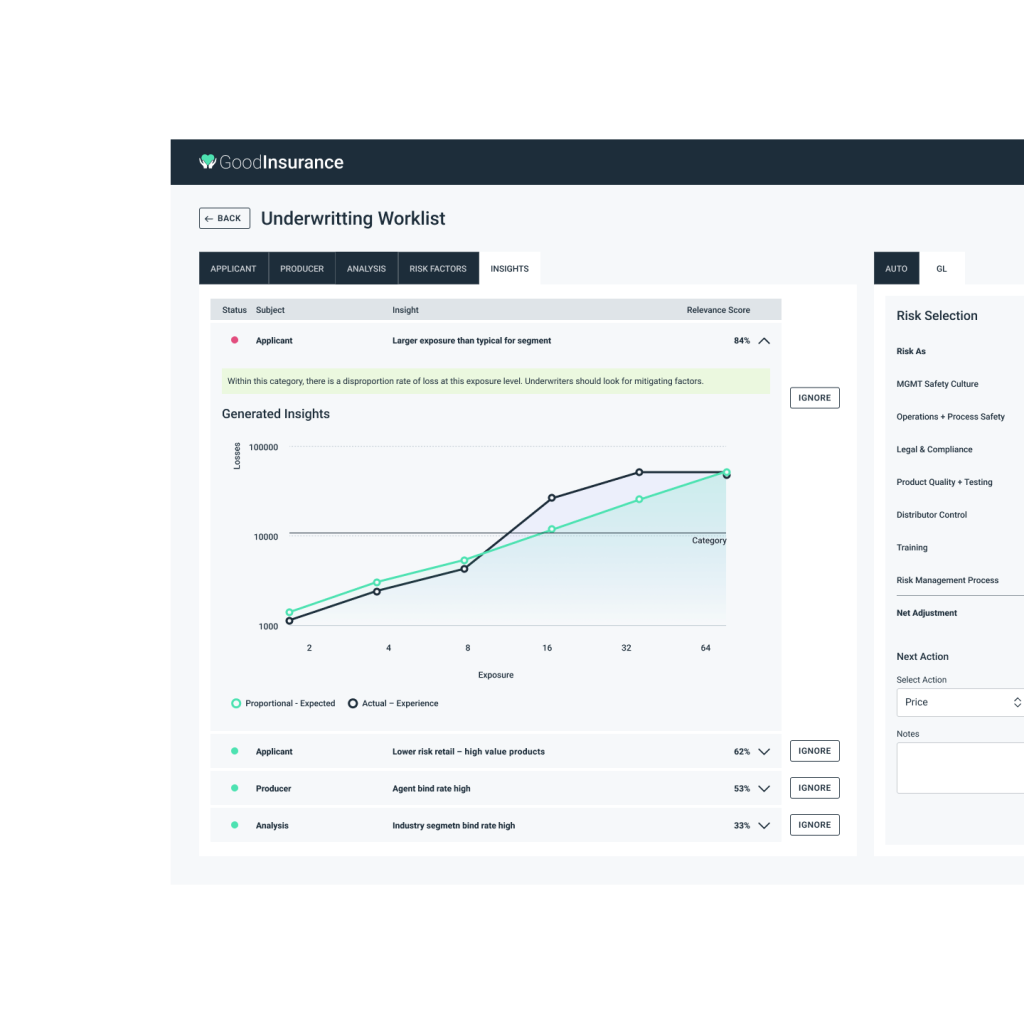

Risk Insights: A 360° View of Risk

Understanding and accounting for risk is central to underwriting, as risk directly influences pricing and profitability. GoodData excels in providing risk insights by integrating data from multiple sources, both internal and external, allowing underwriters to consider all dimensions of risk. This enables them to comprehensively evaluate the factors involved in each submission and make more informed decisions. With this enhanced risk assessment, underwriters can align their pricing strategies more effectively, ultimately driving profitability.

Decision Guidance: A Unified Approach to Decision-Making

GoodData provides underwriters with all the key factors they need for decision-making in one unified platform. By bringing all relevant data into a single, user-friendly interface, GoodData gives underwriters an unprecedented level of visibility and understanding of submission risks. This centralized approach to data analysis helps ensure that underwriting decisions are both aligned with risk and profitability goals. As a result, underwriters are better equipped to balance risk and pricing strategies, leading to improved business performance.

The Bottom Line: A Shift from Administration to Strategic Decisions

In today's fast-paced insurance market, the ability to make timely and well-informed decisions is more important than ever. However, traditional underwriting workflows often leave underwriters bogged down with administrative tasks, preventing them from dedicating their efforts to evaluating risks and maximizing profitability. GoodData changes this by shifting the focus away from manual, time-consuming data tasks and toward strategic decision-making. By providing underwriters with comprehensive insights into submissions, risk, and profitability, GoodData enables organizations to make faster, smarter, and more profitable underwriting decisions.

With GoodData, underwriters no longer need to waste time searching for and compiling data—they can focus on what truly matters: making decisions that drive business success.