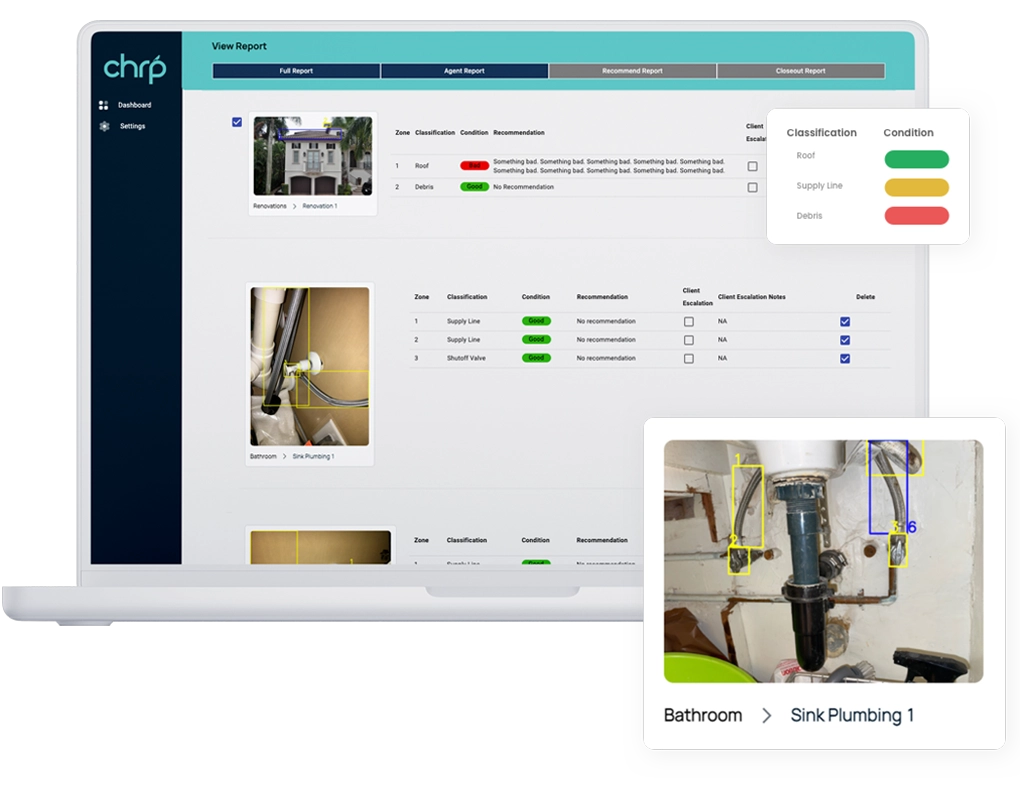

The ability to swiftly and accurately identify potential risks is paramount. Chrp, a cutting-edge risk prevention automation tool, ensures that hazards are not only identified but also front-and-center in the underwriting process. Through its precision-driven automation, Chrp highlights the “needle in the haystack,” so underwriters can focus on the most critical risks while avoiding the distraction of less relevant details.

With Chrp, your underwriters can confidently make decisions, knowing they aren’t missing any potential hazards that could affect future claims. The efficiency gained from Chrp allows your team to zero in on the risks that matter most, leading to better risk assessments and a healthier book of business.

Healthy Book of Business Powered by Chrp

At the core of Chrp’s mission is to empower insurers to build and maintain a thriving portfolio. By detecting potential hazards early, before they evolve into future claims, Chrp equips your team with the tools they need to stay ahead of risk. Through AI-powered risk detection, Chrp enables you to maintain a healthy book of business that is less likely to be burdened by unforeseen claims.

Chrp's AI technology works tirelessly to analyze risk, ensuring that no potential hazard slips through the cracks. This level of precision allows insurers to make data-driven decisions with confidence, strengthening the portfolio with each underwriting decision.

Detect Hazards Before They Become Claims

In an industry where proactive risk management is the key to success, Chrp provides an unmatched advantage. By identifying and accounting for hazards at the earliest stage, Chrp reduces the likelihood of costly future claims. This foresight empowers insurers to offer competitive policies, while maintaining profitability through careful risk selection.

Chrp isn’t just about detecting hazards – it’s about ensuring those risks are clearly communicated and factored into the underwriting decision. With its comprehensive reporting, your team can focus on the insights that matter, driving efficiency and eliminating unnecessary review of irrelevant minutiae.

Scale Your Book of Business with Automated Underwriting

Chrp’s risk prevention automation is more than just a tool – it’s a strategy for growth. By leveraging AI technology, insurers can scale their operations without compromising on quality. Chrp allows underwriters to manage more policies, process applications faster, and focus on building a portfolio that is both robust and healthy.

As insurers increasingly turn to automation, Chrp stands out as a solution that not only improves risk detection but also allows for the seamless scaling of your book of business. By automating underwriting processes, insurers can save time, reduce manual errors, and ensure that every decision is backed by precise data.

Insurers Use Chrp® AI to Build a Robust Portfolio of Healthy Homes™

For home insurers, building a portfolio of well-assessed properties is critical to long-term success. Chrp® AI enables insurers to confidently build a portfolio of “Healthy Homes™” by ensuring that potential hazards are accounted for upfront. The result is a book of business that is resilient, profitable, and primed for growth.

Whether you’re looking to streamline your underwriting processes, enhance risk prevention, or scale your business, Chrp offers the automation and precision your team needs. By using Chrp, insurers can transform their approach to underwriting, ensuring that every decision is informed, efficient, and risk-averse.

Unlock the Power of Chrp, Chrp isn’t just a tool – it’s a game-changer in the world of insurance underwriting. Equip your team with the technology to spot hazards before they become claims and watch your portfolio grow in both size and health. Embrace automation, streamline your processes, and build a future-ready book of business with Chrp.